DIGITAL LENDING AUTOMATION

Transforming BFSI with AI/ML

Digital lending automation represents a paradigm shift in the Banking, Financial Services, and Insurance (BFSI) sector, leveraging Artificial Intelligence and Machine Learning to streamline, optimize, and revolutionize credit delivery systems. This transformation is moving lending from weeks to minutes while simultaneously reducing risk and enhancing customer experience.

Core Components of AI/ML-Powered Lending Automation

1. Intelligent Customer Acquisition

AI-driven lead scoring identifies high-intent customers using behavioral analytics

Predictive analytics for pre-approved offers based on alternative data sources

Chatbot-assisted initial inquiries and application initiation

Omnichannel integration across web, mobile, and partner platforms

2. Automated Application Processing

Smart document processing using Computer Vision and OCR

Automated data extraction from bank statements, tax documents, and IDs

Real-time form validation and auto-completion

Biometric verification for identity authentication

3. Advanced Credit Decisioning

Traditional Model Enhancement

Alternative data integration: Utility payments, rent history, e-commerce behavior

Cash flow underwriting: Real-time analysis of bank transactions

Social and behavioral signals (with privacy safeguards)

ML-Powered Risk Assessment

Predictive default models with higher accuracy than traditional FICO scores

Ensemble models combining multiple algorithms for robust predictions

Explainable AI (XAI) providing transparent rationale for decisions

4. Automated Compliance & Fraud Detection

Real-time AML/KYC checks against global databases

Pattern recognition for identifying synthetic identities

Behavioral biometrics detecting anomalies during application

Regulatory compliance automation adapting to changing requirements

5. Dynamic Loan Servicing

AI-powered collection strategies predicting optimal contact times/methods

Personalized restructuring options using ML models

Automated payment processing with smart exception handling

Proactive engagement for at-risk accounts

Transformational Impact on BFSI

For Lenders:

70-80% reduction in loan processing time

30-40% decrease in operational costs

25-35% improvement in risk assessment accuracy

Enhanced portfolio quality with better risk segmentation

Scalability to handle volume spikes without proportional cost increases

For Customers:

Frictionless experience: 5-10 minute application processes

24/7 availability without human intervention

Higher approval rates through alternative data inclusion

Personalized products tailored to individual circumstances

Transparent processes with real-time status updates

Case Study: DBS Bank’s AI-Powered Transformation

Client: DBS Bank (Digital Bank of Singapore)

Background: Founded in 1968, DBS is Southeast Asia’s largest bank with operations across 18 markets

Assets: ~$740 billion (2024)

Vision: “To be the best bank for a better world” through digital innovation

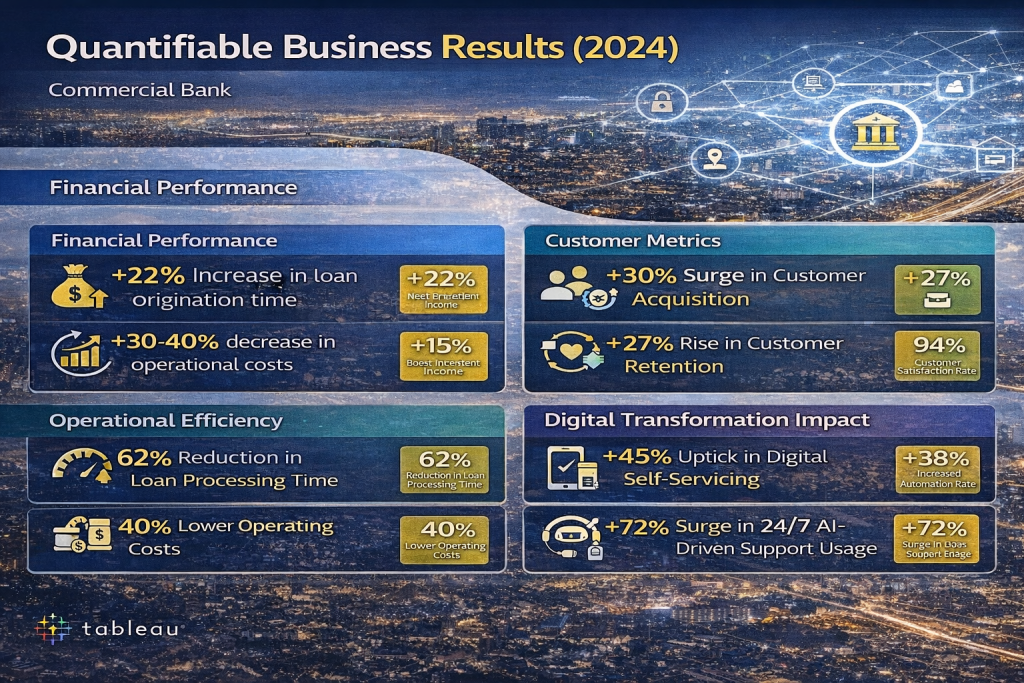

Financial Performance

| Metric | 2014 (Pre-AI) | 2024 (Post-AI) | Change | Color Indicator |

|---|---|---|---|---|

| Market Capitalization | $32 Billion | $98 Billion | +206% | 🟢 |

| Digital Revenue Share | 22% | 58% | +36 percentage points | 🟢 |

| Cost-Income Ratio | 44% | 37% | -7 percentage points | 🟢 |

| Return on Equity (ROE) | 10.2% | 15.6% | +5.4 percentage points | 🟢 |

| Stock Performance | – | Outperformed STI by 180% | – | 🟢 |

Customer Metrics

| Metric | 2014 | 2024 | Change | Color Indicator |

|---|---|---|---|---|

| Digital Customer Base | 2.1 Million | 8.9 Million | +324% | 🟢 |

| Mobile Transactions | 21% | 78% | +57 percentage points | 🟢 |

| Net Promoter Score (Retail) | 38 | 68 | +30 points | 🟢 |

| App Store Rating | 2.8 ⭐ | 4.8 ⭐ | +2.0 stars | 🟢 |

| Average Service Time | 8 minutes | 45 seconds | -91% | 🟢 |

Future Trends & Evolution

Next-Generation Capabilities:

Federated Learning: Collaborative models without sharing sensitive data

Quantum Computing: Solving complex optimization problems

Blockchain Integration: Immutable loan agreements and smart contracts

IoT Data Integration: Real-time asset monitoring for secured lending

Market Projections:

Global AI in fintech market to reach $61.3 billion by 2031 (CAGR: 23.5%)

Digital lending platforms to process over 60% of all loans by 2027

Embedded lending becoming standard in e-commerce and SaaS platforms

Implementation Roadmap

Phase 1 (0-6 months):

Proof of concept with single product line

API integration with core systems

Basic automation of document processing

Phase 2 (6-18 months):

Expanded product coverage

Advanced ML models for risk assessment

Omnichannel customer experience

Phase 3 (18-36 months):

Full AI-powered lending ecosystem

Predictive customer lifecycle management

AI-driven product innovation

Conclusion

Digital lending automation powered by AI/ML is not merely an efficiency tool but a fundamental reimagining of credit delivery. The transformation enables democratized access to credit, superior risk management, and sustainable profitability in an increasingly competitive landscape. Financial institutions that successfully implement these technologies will gain significant competitive advantages, while those who lag risk obsolescence in the evolving digital financial ecosystem.

The convergence of advanced analytics, automation, and customer-centric design is creating a new paradigm where lending decisions are faster, fairer, and more accurate than ever before, ultimately driving financial inclusion and economic growth while maintaining robust risk management standards.

Financial Performance

| Metric | 2014 (Pre-AI) | 2024 (Post-AI) | Change | Color Indicator |

|---|---|---|---|---|

| Market Capitalization | $32 Billion | $98 Billion | +206% | 🟢 |

| Digital Revenue Share | 22% | 58% | +36 percentage points | 🟢 |

| Cost-Income Ratio | 44% | 37% | -7 percentage points | 🟢 |

| Return on Equity (ROE) | 10.2% | 15.6% | +5.4 percentage points | 🟢 |

| Stock Performance | – | Outperformed STI by 180% | – | 🟢 |